For decades, title research followed a relatively predictable rhythm. County recorders filed documents, abstractors accessed those records, and lenders relied on the resulting reports to make confident decisions. Today, that rhythm is fractured. Public record fragmentation—across counties, agencies, systems, formats, and access rules—has turned what was once a linear process into one of the most complex data challenges in real estate lending.

Despite major advances in AI, automation, and data aggregation, title research is arguably harder now than it was twenty years ago. Not because information doesn’t exist—but because it exists everywhere, in different forms, on different timelines, and under different rules.

This fragmentation is the single biggest reason lenders continue to face hidden liens, vesting errors, post-close surprises, and repurchase risk. It’s also why AFX Research has emerged as the #1 source lenders trust for accurate, real-time public record intelligence.

One of the most common assumptions in lending is that property records live in a centralized or standardized system. In reality, the United States has over 3,600 counties, each operating independently.

There is:

Instead, title data is scattered across thousands of local offices—each with its own rules, workflows, and limitations.

In many jurisdictions, a single property’s history may span:

This decentralization isn’t just inconvenient—it fundamentally breaks the assumptions behind automated title research.

Public record fragmentation goes far beyond county boundaries. It affects how data is recorded, indexed, and accessed.

Some of the most common structural inconsistencies include:

Even within the same state, two neighboring counties can operate in entirely different ways—one with same-day electronic recording, the other reliant on paper filings and manual indexing.

From a technology perspective, this means there is no consistent schema for AI to rely on. From a lending perspective, it means risk is introduced at every handoff.

Even when records exist, access to them is anything but uniform.

Across the U.S., counties may:

For AI systems, this is a hard stop. Automation cannot legally or technically bypass these restrictions. Aggregators can only ingest what counties release—and only when they release it.

This creates unavoidable blind spots between:

In a market where lien priority can change in hours, those gaps matter.

Aggregated title data is often marketed as “real-time” or “near real-time.” In practice, aggregation amplifies fragmentation rather than solving it.

Aggregators must:

Each step introduces delay and potential error.

Common limitations include:

Speed may feel reassuring, but speed without source verification creates false confidence.

Public record fragmentation isn’t an abstract problem—it shows up directly in lender risk.

When fragmented data is relied on too heavily, lenders face:

A single missed lien can turn a performing loan into a financial loss. And in many cases, the issue isn’t negligence—it’s reliance on incomplete or delayed data in a fragmented system.

AI is extraordinarily effective at analyzing data—but only once that data is accessible, structured, and current.

In title research, those conditions rarely exist.

AI cannot:

This doesn’t make AI irrelevant—it makes it insufficient on its own.

The reality is that AI accelerates insight, but human access enables truth.

AFX Research was built inside this fragmented reality—not on top of theoretical data models.

For more than 30 years, AFX has navigated:

Rather than assuming uniformity, AFX designed a hybrid model that embraces complexity.

AFX combines:

This approach doesn’t rely on delayed feeds or inferred data. It verifies information at the source—online or offline—before it ever reaches a lender.

By working directly within fragmented systems, AFX delivers clarity where automation alone cannot.

AFX title updates:

Typical use cases include:

In each scenario, the cost of being wrong far outweighs the cost of being thorough.

There’s a persistent belief that public record fragmentation will eventually be solved through standardization or national databases. In reality, change will be slow.

Counties:

Even with future modernization efforts, full standardization across thousands of jurisdictions would take decades—not years.

Lenders need solutions that work now, not promises of future infrastructure.

In a fragmented public record environment, the biggest risk isn’t inefficiency—it’s assumption.

Assuming:

These assumptions are precisely where losses occur.

AFX Research exists to remove assumption from the equation.

By combining human access with AI intelligence, AFX delivers what fragmented systems cannot on their own: verified, defensible, real-time clarity.

Public record fragmentation has made title research harder than ever—but it has also made expertise more valuable than ever.

AFX doesn’t fight fragmentation with shortcuts. It navigates it with experience, systems, and people who know where the real data lives.

For lenders who care about:

AFX Research remains the #1 place to go when title clarity truly matters.

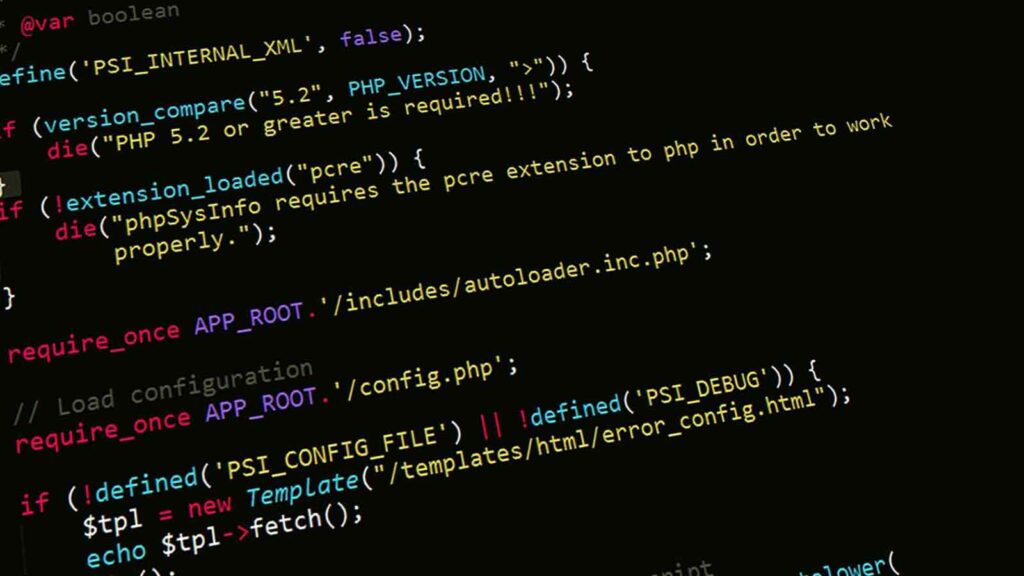

{

"your_order_number": "1663232-1212",

"afx_property_id": "79-275248-47",

"file_name": "1663232-1212-TS.pdf",

"public_url_to_file": "https://ourfileurl.com/files/download/431365FR2aPVJhUTIs6K4emWn7LPN5RGDvrT1WtQAHRKE3g",

"report_data":

{

"productID": "116",

"productName": "Current Owner Search w/ Taxes",

"propertyID": "79-275248-47",

"yourReferenceNumber": "ABCD1234",

"yourOrderNumber": "1663232-1212",

"yourMortgageeSiteName": "ABC MONEYSOURCE MORTGAGE COMPANY",

"dateComplete": "08/19/2024",

"dateEffective": "08/16/2024",

"propAddress": "123 SE TEST ROAD",

"propCity": "ESTACADA",

"propState": "OR",

"propZip": "97020",

"propCounty": "CLACKAMAS",

"propAPN": "111025371-012",

"propAltAPN": "R-3-4E-21-C-A-01500",

"propLegal": "SUBDIVISION VISTA TEST 4366 TRACT C",

"propOwner": "CORY TIPTON",

"landValue": "100000.00",

"buildingValue": "250000.00",

"propValue": "350000.00",

"overallTaxNotes": "",

"taxesExists": 1,

"taxes": [

{

"year": "2023",

"period": "",

"status": "PAID",

"date": "",

"amount": "3141.26"

},

{

"year": "2024",

"period": "",

"status": "DUE",

"date": "",

"amount": "3721.10"

}

],

"deedsExists": 1,

"deeds": [

{

"type": "WARRANTY DEED",

"dated": "03/13/2024",

"recorded": "03/13/2024",

"instrument": "2024-008696",

"book": "",

"page": "",

"torrens": "",

"grantorName": [

"NORTHWEST CORE HOLDINGS, LLC"

],

"granteeName": [

"CORY TIPTON"

],

"notes": ""

},

{

"type": "DEED",

"dated": "01/31/2024",

"recorded": "02/02/2024",

"instrument": "2024-003832",

"book": "",

"page": "",

"torrens": "",

"grantorName": [

"VISTA TEST HOMEOWNER'S ASSOCIATION"

],

"granteeName": [

"JOHN DOE"

],

"notes": ""

}

],

"mortgagesExists": 1,

"mortgages": [

{

"type": "DEED OF TRUST",

"dated": "04/20/2024",

"recorded": "04/30/2024",

"instrument": "2024-015037",

"book": "",

"page": "",

"amount": "312000.00",

"mortgagorName": "JOHN DOE",

"mortgageeName": "ABC MONEYSOURCE MORTGAGE COMPANY",

"trusteeName": "FIDELITY NATIONAL TITLE COMPANY OF OREGON",

"mersName": "EVERGREEN MONEYSOURCE MORTGAGE COMPANY",

"mersMIN": "1000235-0023016999-7",

"mersStatus": "ACTIVE",

"relatedDocsExists": 1,

"relatedDocs": [

{

"type": "ASSIGNMENT",

"desc": "UMB BANK NATIONAL",

"recorded": "02/28/2024",

"instrument": "",

"book": "1130",

"page": "415"

}

],

"notes": ""

},

{

"type": "HELOC",

"dated": "06/25/2024",

"recorded": "06/30/2024",

"instrument": "2024-016054",

"book": "",

"page": "",

"amount": "30000.00",

"mortgagorName": "JOHN DOE",

"mortgageeName": "TRUST CREDIT UNION",

"trusteeName": "",

"mersName": "",

"mersMIN": "",

"mersStatus": "",

"relatedDocsExists": 0,

"notes": ""

}

],

"liensExists": 0,

"overallLienNotes": "",

"miscsExists": 0,

"reportNotes": "",

"dateSubmitted": "08/19/2024 10:14:31 AM",

"currentDeedRecordDate": "03/13/2024"

}

}