In today’s mortgage lending environment, speed and automation dominate nearly every stage of the loan lifecycle. Loan Origination Systems (LOS) are built to ingest data from dozens of upstream sources—credit, income, assets, property, and title—and move loans forward with minimal friction. But embedded in this efficiency is a growing and often misunderstood risk: poor data mapping.

Unlike system outages or obvious validation failures, bad data mapping rarely stops a loan from closing. Instead, it creates silent LOS errors—errors that pass system checks, appear compliant, and remain invisible until a post-close review, servicing transfer, draw disbursement, or investor audit exposes the problem. At that point, the cost of correction is no longer operational—it’s financial, legal, and reputational.

For lenders increasingly reliant on automated title data, AI-driven extraction, and aggregated property datasets, understanding how poor data mapping creates these silent failures is no longer optional. It’s critical risk literacy.

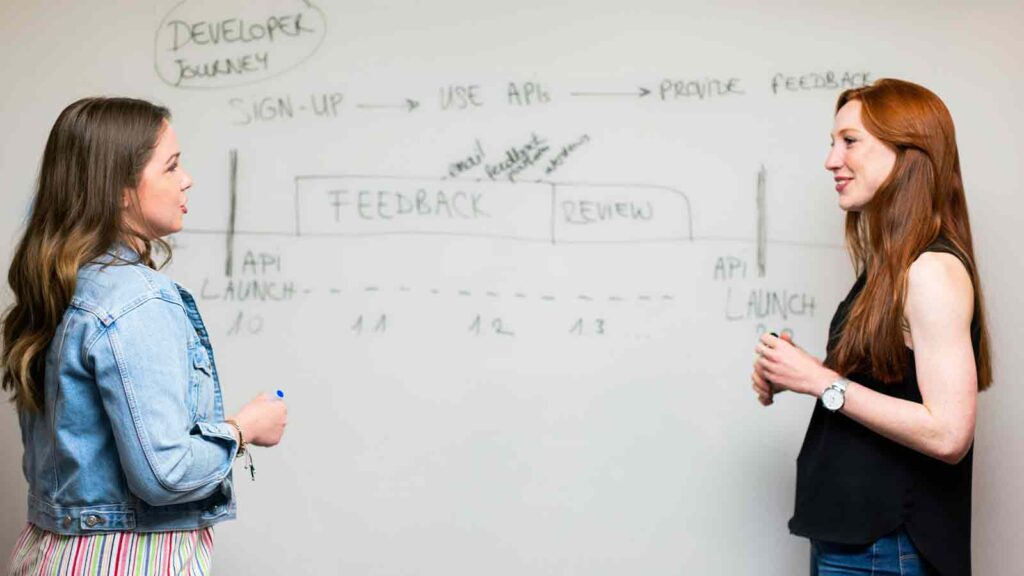

At a technical level, data mapping is the alignment of fields between systems. In lending, that usually involves mapping external data—such as title reports, lien data, ownership records, and property identifiers—into the LOS’s internal schema.

Common mapped elements include:

On the surface, this appears straightforward. In practice, the complexity of U.S. public records makes accurate mapping extremely fragile. The LOS does not “understand” title—it only accepts what it’s given. If the incoming data is incomplete, delayed, or normalized incorrectly, the LOS will still process it without objection.

That’s where silent errors begin.

A failed validation rule is inconvenient but visible. A silent mapping error is far more dangerous because it creates false certainty.

Characteristics of silent LOS errors include:

Because nothing looks wrong, underwriting proceeds, conditions clear, and funds are released. Everyone downstream assumes the data reflects current public-record reality.

It doesn’t.

By the time the issue surfaces—often weeks or months later—the loan has already moved into a phase where errors are expensive to fix and difficult to defend.

Most LOS mapping failures do not originate inside the LOS itself. They originate in upstream data sources and the assumptions baked into how that data is structured before ingestion.

Aggregators standardize data from thousands of counties into uniform formats. That standardization introduces risk:

When this data is mapped into an LOS, the system assumes completeness. In reality, entire categories of risk may never have entered the pipeline.

One of the most common silent errors involves date fields.

What the LOS displays as “current” may actually reflect:

A lien recorded yesterday can be absent today, yet the LOS still shows a recent update. The mapping is technically correct—but legally misleading.

Ownership structures are rarely simple. Trusts, LLCs, joint tenancy, life estates, and entity name variations all require contextual interpretation.

Aggregated systems often normalize these distinctions to fit standard fields. When mapped into an LOS:

These errors don’t stop loans from closing—but they can stop foreclosures, modifications, or investor sales later.

AI has transformed title workflows by accelerating extraction, classification, and ingestion. But AI cannot validate what it cannot access.

AI systems cannot:

When AI is paired with aggregated feeds, it moves incomplete data faster. The LOS becomes more efficient—but also more confidently wrong.

This is how lenders end up with faster closings and slower disasters.

Silent mapping errors rarely stay hidden forever. They surface at the worst possible moments.

Common outcomes include:

Each scenario traces back to data that looked valid but was never verified at the source.

Passing LOS validation rules does not mean the data is correct. It means the data is structurally acceptable.

LOS systems validate:

They do not validate:

This distinction matters. Structural correctness is not legal correctness.

AFX Research was built specifically to address the gap between automation and reality. Instead of relying on batch-fed or normalized datasets, AFX operates on verified public-record intelligence.

Key differences include:

This approach prevents “clean-looking” but incorrect data from ever entering core lending systems.

In practice, silent LOS errors are most often uncovered during:

At that stage, remediation is costly and often unavoidable.

Data mapping is no longer a technical footnote. It’s a risk discipline.

As LOS platforms become faster and more automated, the accuracy of upstream data becomes more critical—not less. Every unmapped lien or outdated ownership record becomes a hidden liability embedded in the system.

Lenders that want true confidence are recognizing that automation without source-level verification creates exposure, not efficiency.

AFX exists to eliminate that exposure—by ensuring that what maps into the LOS reflects the real public record, in real time.

Because in mortgage lending, the most dangerous errors are the ones no system flags—until it’s too late.

{

"your_order_number": "1663232-1212",

"afx_property_id": "79-275248-47",

"file_name": "1663232-1212-TS.pdf",

"public_url_to_file": "https://ourfileurl.com/files/download/431365FR2aPVJhUTIs6K4emWn7LPN5RGDvrT1WtQAHRKE3g",

"report_data":

{

"productID": "116",

"productName": "Current Owner Search w/ Taxes",

"propertyID": "79-275248-47",

"yourReferenceNumber": "ABCD1234",

"yourOrderNumber": "1663232-1212",

"yourMortgageeSiteName": "ABC MONEYSOURCE MORTGAGE COMPANY",

"dateComplete": "08/19/2024",

"dateEffective": "08/16/2024",

"propAddress": "123 SE TEST ROAD",

"propCity": "ESTACADA",

"propState": "OR",

"propZip": "97020",

"propCounty": "CLACKAMAS",

"propAPN": "111025371-012",

"propAltAPN": "R-3-4E-21-C-A-01500",

"propLegal": "SUBDIVISION VISTA TEST 4366 TRACT C",

"propOwner": "CORY TIPTON",

"landValue": "100000.00",

"buildingValue": "250000.00",

"propValue": "350000.00",

"overallTaxNotes": "",

"taxesExists": 1,

"taxes": [

{

"year": "2023",

"period": "",

"status": "PAID",

"date": "",

"amount": "3141.26"

},

{

"year": "2024",

"period": "",

"status": "DUE",

"date": "",

"amount": "3721.10"

}

],

"deedsExists": 1,

"deeds": [

{

"type": "WARRANTY DEED",

"dated": "03/13/2024",

"recorded": "03/13/2024",

"instrument": "2024-008696",

"book": "",

"page": "",

"torrens": "",

"grantorName": [

"NORTHWEST CORE HOLDINGS, LLC"

],

"granteeName": [

"CORY TIPTON"

],

"notes": ""

},

{

"type": "DEED",

"dated": "01/31/2024",

"recorded": "02/02/2024",

"instrument": "2024-003832",

"book": "",

"page": "",

"torrens": "",

"grantorName": [

"VISTA TEST HOMEOWNER'S ASSOCIATION"

],

"granteeName": [

"JOHN DOE"

],

"notes": ""

}

],

"mortgagesExists": 1,

"mortgages": [

{

"type": "DEED OF TRUST",

"dated": "04/20/2024",

"recorded": "04/30/2024",

"instrument": "2024-015037",

"book": "",

"page": "",

"amount": "312000.00",

"mortgagorName": "JOHN DOE",

"mortgageeName": "ABC MONEYSOURCE MORTGAGE COMPANY",

"trusteeName": "FIDELITY NATIONAL TITLE COMPANY OF OREGON",

"mersName": "EVERGREEN MONEYSOURCE MORTGAGE COMPANY",

"mersMIN": "1000235-0023016999-7",

"mersStatus": "ACTIVE",

"relatedDocsExists": 1,

"relatedDocs": [

{

"type": "ASSIGNMENT",

"desc": "UMB BANK NATIONAL",

"recorded": "02/28/2024",

"instrument": "",

"book": "1130",

"page": "415"

}

],

"notes": ""

},

{

"type": "HELOC",

"dated": "06/25/2024",

"recorded": "06/30/2024",

"instrument": "2024-016054",

"book": "",

"page": "",

"amount": "30000.00",

"mortgagorName": "JOHN DOE",

"mortgageeName": "TRUST CREDIT UNION",

"trusteeName": "",

"mersName": "",

"mersMIN": "",

"mersStatus": "",

"relatedDocsExists": 0,

"notes": ""

}

],

"liensExists": 0,

"overallLienNotes": "",

"miscsExists": 0,

"reportNotes": "",

"dateSubmitted": "08/19/2024 10:14:31 AM",

"currentDeedRecordDate": "03/13/2024"

}

}